workers comp taxes texas

Most income earned by Texas residents is taxable and so must be reported on their federal tax returns. Workers compensation complete listing of forms.

Light Duty Or Modified Duty Works For Employers And Employees Employers Resource

The quick answer is that generally workers compensation benefits are not taxable.

. It doesnt matter if theyre receiving benefits for a slip and fall accident muscle strain back injury. Household employers in Texas are not required to carry a workers compensation insurance policy however we recommend doing so. Fill Out 1 Easy Form Get 5 Quotes Save Up to 75.

Texas Workers Compensation laws are complex and impact many areas of an injured workers life and future. To limit or dispute your medical care and. Act fast to get early bird pricing for the 2022 Texas Workers Compensation Conference.

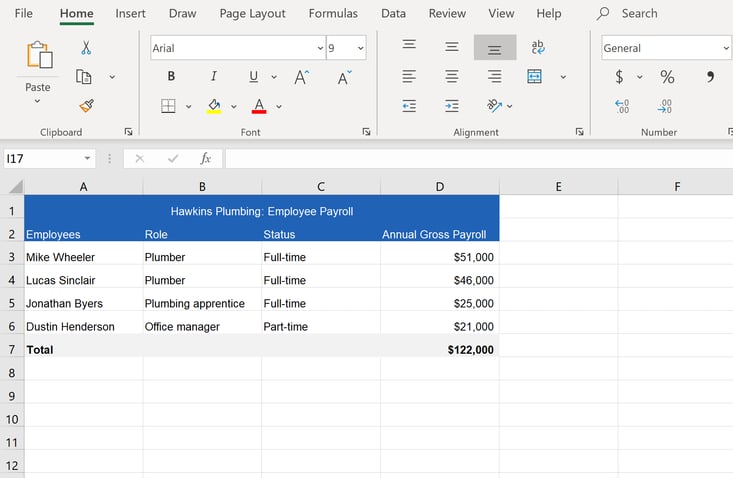

Calculate Your Texas Workers Comp Benefits. Abbott and Associates LLC has provided this tool as a way of calculating an approximated amount of your Texas Workers Comp Income. You pay unemployment tax on the first 9000 that each employee earns during the calendar year.

This is a complete listing of all Division of Workers Compensation Forms. These policies pay for medical expenses and lost. However there are some situations when this general rule does not.

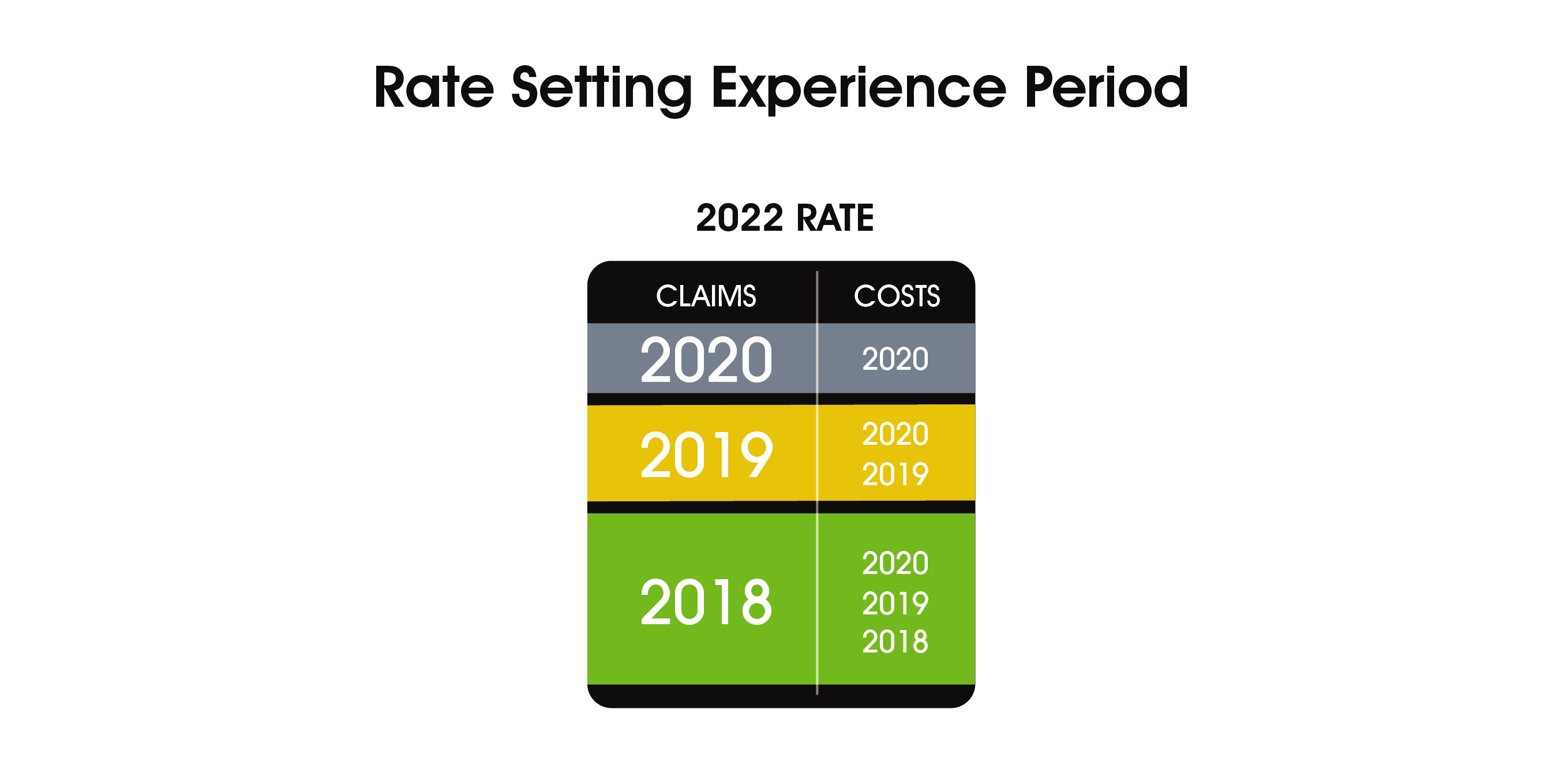

The Texas Workforce Commission indicates that the effective tax rate in 2019 ranges from a minimum of 036 paid by 656 of employers to a maximum of 636 paid by 53 of. The insurance carrier has one goal. Ad Its Fast Easy To Get Workers Comp Coverage.

If they use independent contractors they dont have to pay payroll taxes on them or buy workers comp insurance for them. Sole Props Entrepreneurs Small Shops Side Hustles. Why use cost containment engineering Inc.

Sole Props Entrepreneurs Small Shops Side Hustles. Do you claim workers comp on taxes the answer is no. The chart below contains the Texas Workers Compensation Acts established maximum and minimum weekly benefits applicable to injury dates on or after January 1 1991.

The forms are also available in individual listings. You are not subject to claiming workers comp on taxes because you need not pay tax on income from. Rates are only 325 until May 1 and are 425 after that date.

Make Sure Youre Protected From Unexpected Accidents. Maximum Tax Rate for 2022 is 631 percent. Texas workers compensation law has caught up to.

Ad Its Fast Easy To Get Workers Comp Coverage. For your predominant use study and tax exemption certificationOur pricing is very competitive anywhere in Texas. Texas unlike other states does not require an employer to have workers compensation coverage.

The nations best care and services for injured employees and their employers. Workers Compensation Research and Evaluation Group. Minimum Tax Rate for 2022 is 031 percent.

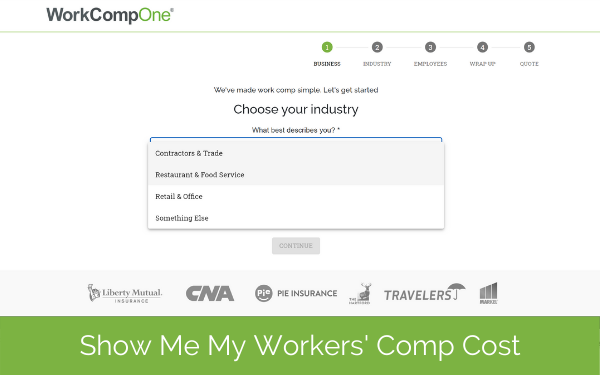

Ad Looking For Workers Comp Insurance. Subscribing to workers compensation insurance puts a limit on the.

Is Workers Comp Taxable Hourly Inc

Is Workers Comp Taxable Workers Comp Taxes

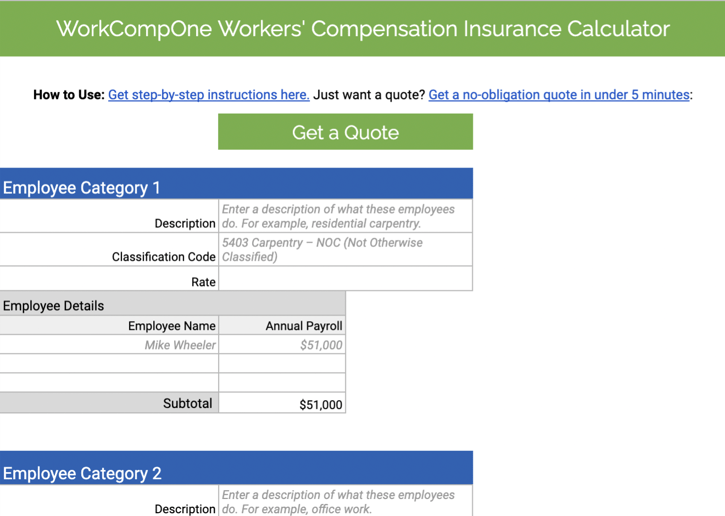

Workers Compensation Insurance Cost Calculator How Much For A Small Business Policy

What Is Workers Compensation Article

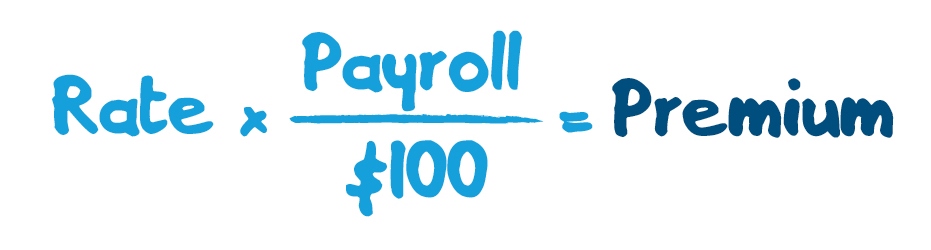

How Premiums Are Calculated Workers Compensation Board Of Manitoba

Taxable Benefits From Workers Compensation In Texas

What Is Workers Compensation Article

How To Calculate Workers Compensation Cost Per Employee

What Is Workers Compensation Article

How Much Does Workers Comp Insurance Cost Calculator Embroker

What Wages Are Subject To Workers Comp Hourly Inc

How To Complete The Workers Compensation Form Youtube

Is Workers Comp Taxable Hourly Inc

How Are My Workers Compensation Benefits Calculated Kbg Injury Law

Texas Workers Compensation Insurance Laws Forbes Advisor

How Premiums Are Calculated Workers Compensation Board Of Manitoba

The 13 Benefits Of The Best Workers Comp Insurance Advantage Insurance Solutions The 13 Benefits Of The Best Workers Comp Insurance